4 Essential Business Skills for Auxiliary Leaders

David Branson, CFO and COO at the Branson School, describes himself as "bullish" about the future of independent schools, feeling optimistic about their ability to thrive in our changing world. But he is clear-eyed about the challenges that must be met, citing recent alarming data:

- In the last decade, 1200 religious schools have closed or consolidated

- Since 2016, more than 25 small, private colleges have closed

- Harvard professor Clayton Christensen and his research colleagues predict that nearly 50% of colleges will close in the next decade

In California, school closings have become so common that the state DOE now offers the "Best Practices Guide for Potential School Closure." And the most at-risk schools for closure across the United States, regardless of urban or rural settings, are small schools--those with smaller endowments, lower tuition, and lower average family income. David says the reasons for closures include a broken business model, discount rates above 35%, and an inability to attract new students and revenue to cover costs.

1. Understand Why the Supply/Demand Model Doesn't Work for Independent Schools

While most of us think of the basic business model as making a profit by creating supply to meet demand, David says it does not apply to independent schools because making a profit is not our goal.

As primarily non-profits, independent schools provide a service at a price less than the cost of that service, which creates an operating gap in the budget that must be covered. We are mission-driven, human-focused businesses and need to adopt a financial model that works differently--one that recognizes and accounts for this gap.

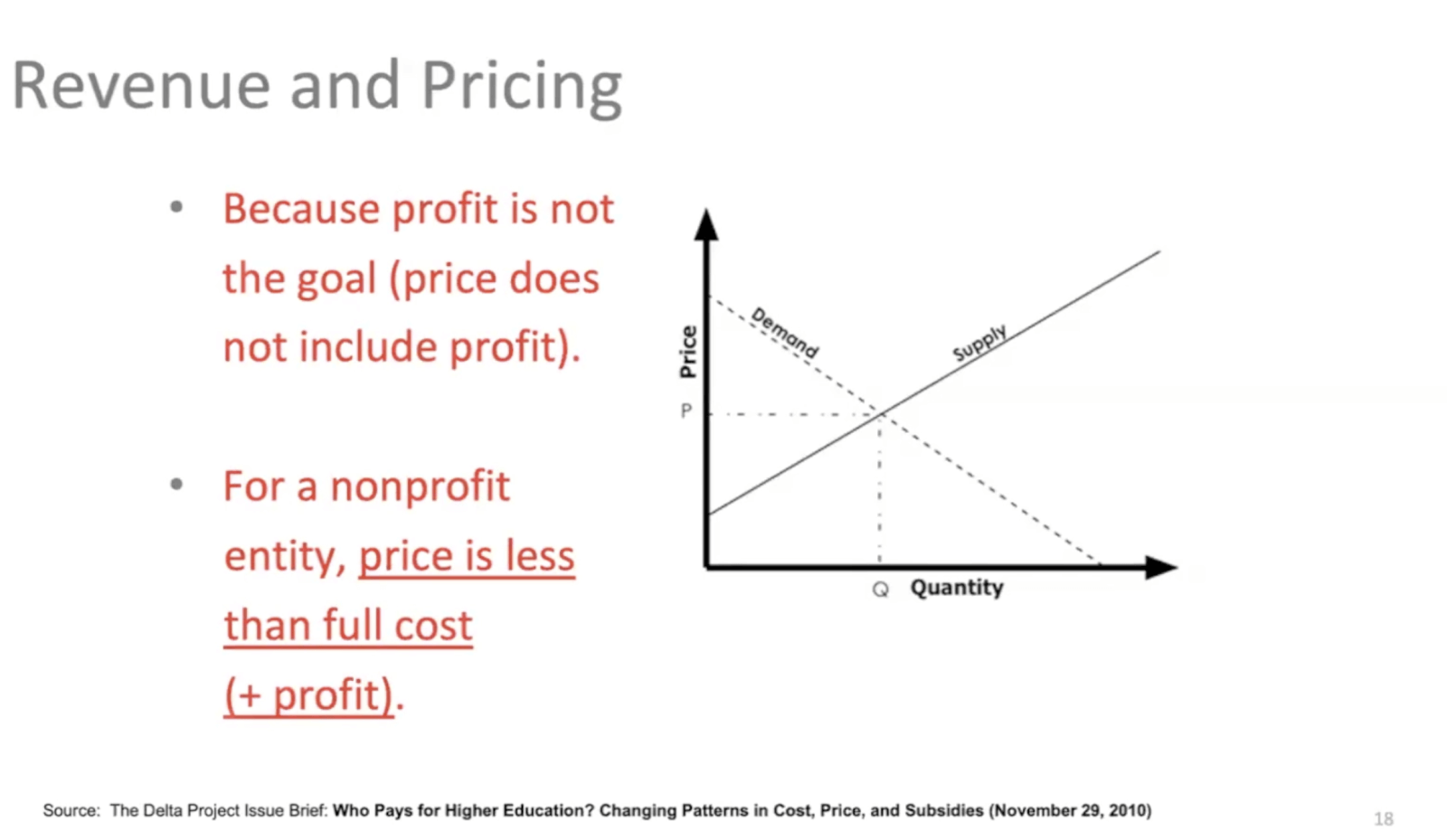

2. Know Your Financial Statements

If you understand your school's three most important financial statements, David states, then you'll have a better understanding of your school's financial health. These are the three most important:

Statement of Financial Position (the Balance Sheet): Details your school's assets and liabilities. Assets include the gym, field, HOS house, etc. But what constitutes a liability for a school is tricky, so it's better to think in terms of net assets, which you can see in the next statement.

Statement of Activities (Income/Profit and Loss): Shows all the revenue coming in, both tuition and non-tuition sources, and expenses. Revenue minus expenses equals your net assets. Understanding the flow--the increase or decrease in net assets--is key to understanding the other statements and how they tie together.

Statement of Cash Flow: What your school is spending on infrastructure, financing activities, investment activities, etc.

3. Calculate Your "Gap"

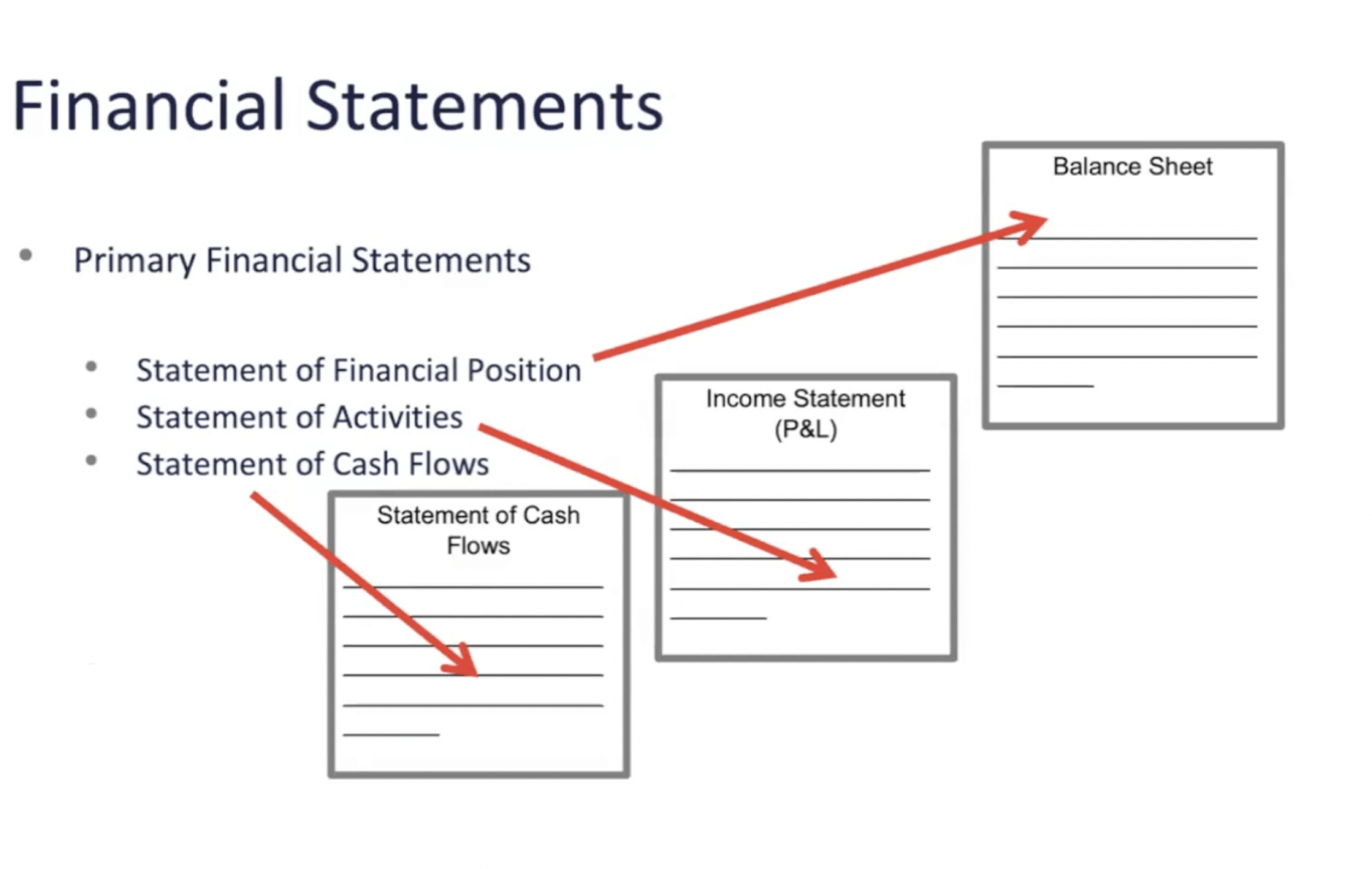

In this slide, we see Branson School's operating costs. The Net Tuition and Fees is all tuition revenue coming in after discounts, remission, financial aid, etc. Because independent schools set their tuition per student at lower than the cost to educate that student, a gap exists that must be covered by other sources of revenue.

Using your own school's numbers from your three key financial statements, you can calculate the gap that exists between your operating costs and net revenue. Calculating this gap is essential to planning for the financial health of your school and managing the budget.

4. Leverage the Power of Auxiliary Programs

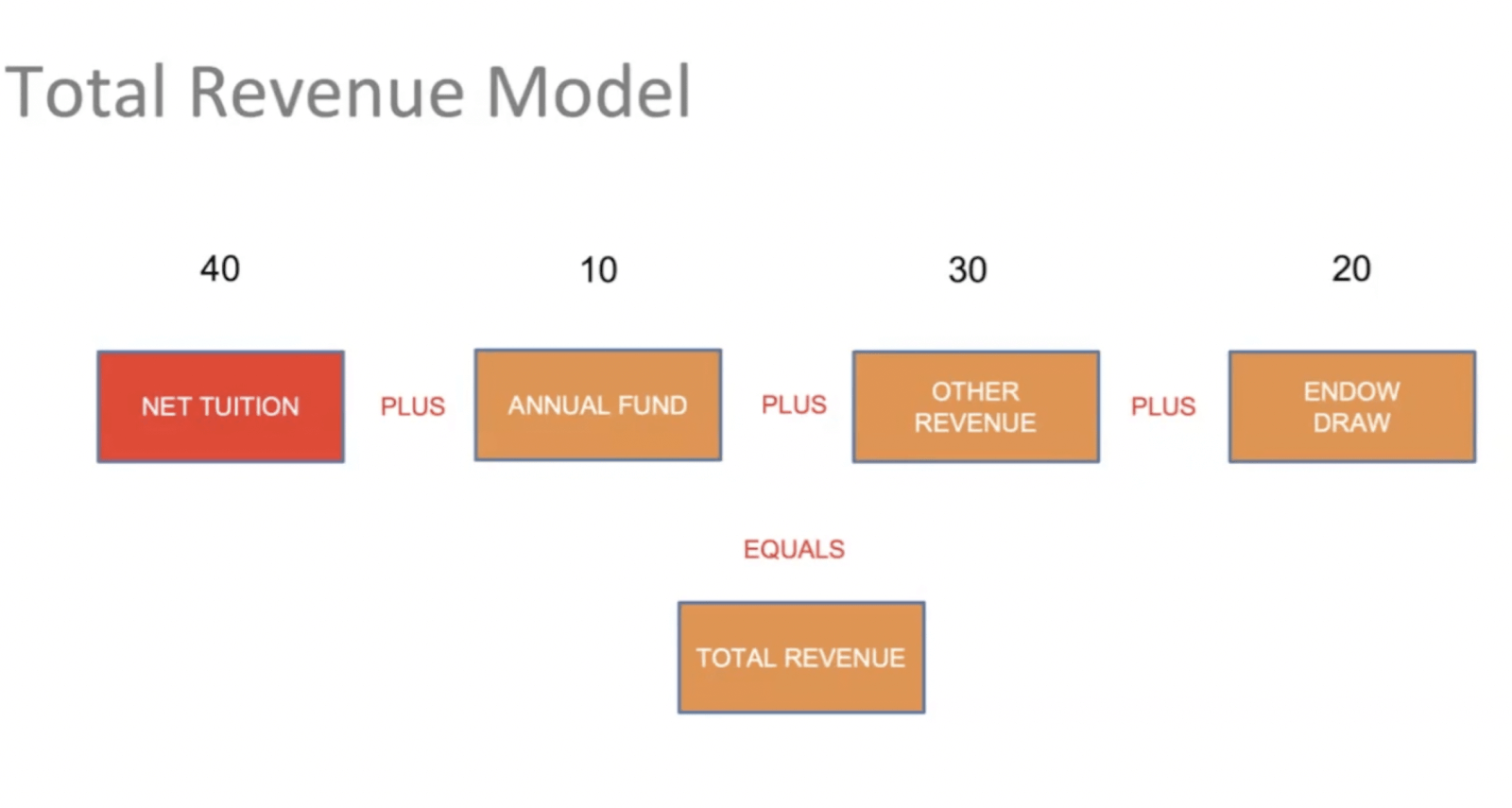

Covering the gap between costs and revenue requires a diversified portfolio of non-tuition sources, including endowment draw, investment income, and philanthropy. But every year, auxiliary programs are becoming more of a key player in creating non-tuition revenue that fills this gap and allows independent schools to thrive and become financially stable. The chart above shows David's ideal vision of how much an independent school would rely on each source of revenue.

Once you have a basic understanding of your schools financial statements, your budget, and the gap that needs to be filled, you are in a strong position to advocate for your summer and after school programs and their power to help your school plan for and create long-term financial viability. Revenue from auxiliary programs outpaces, on average, that gained from either annual giving or interest and investments. In fact, average auxiliary expense per student has increased 5.4%, while revenue per student has increased at a greater rate--12.8%

On SPARC Connect you'll find a variety of tools and information to help you increase the value of your programs:

"Understanding the Business Fundamentals of School Leadership:" David Branson's SPARC webinar

"How Auxiliary Can Power a New Model for Independent School Revenue" This article on the SPARC blog draws on Jeff Sheild's keynote presentation at this year's SPARC Symposium, discussing both the gap between cost and net revenue and the unique power of auxiliary to shift the independent school model toward long-term financial stability.

The SWOT Analysis, which David says is essential to planning for your department's financial future, lets you determine your strengths, weaknesses, opportunities, and threats.

The SPARC Compass lets you plan your department's time and responsibilities for the year.

The Sample Org Chart helps you identify other departments in your school so you can reach out, connect, and create partnerships to further enhance the impact of your programs.

SPARC is the number one source for auxiliary professional development and community. Join us today to gain access to our wealth of resources, including webinars, roundtables, tools, event discounts, and powerful community support.